free cash flow yield plus growth

Free cash flow yield is really just the companys free cash flow divided by its market value. In 2021 Charter had 825bn of FCF or 633bn adjusted for the start of cash taxes implying a 97.

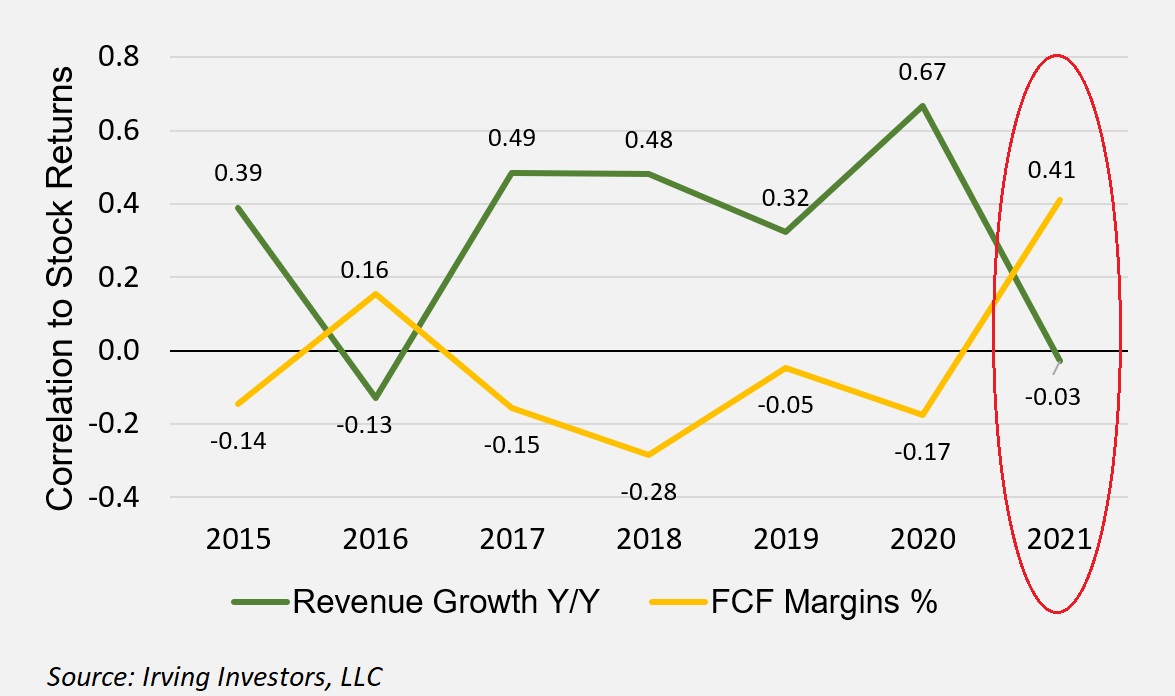

For The First Time In 4 Years Profitability Beats Growth Techcrunch

Dont let this fool you though.

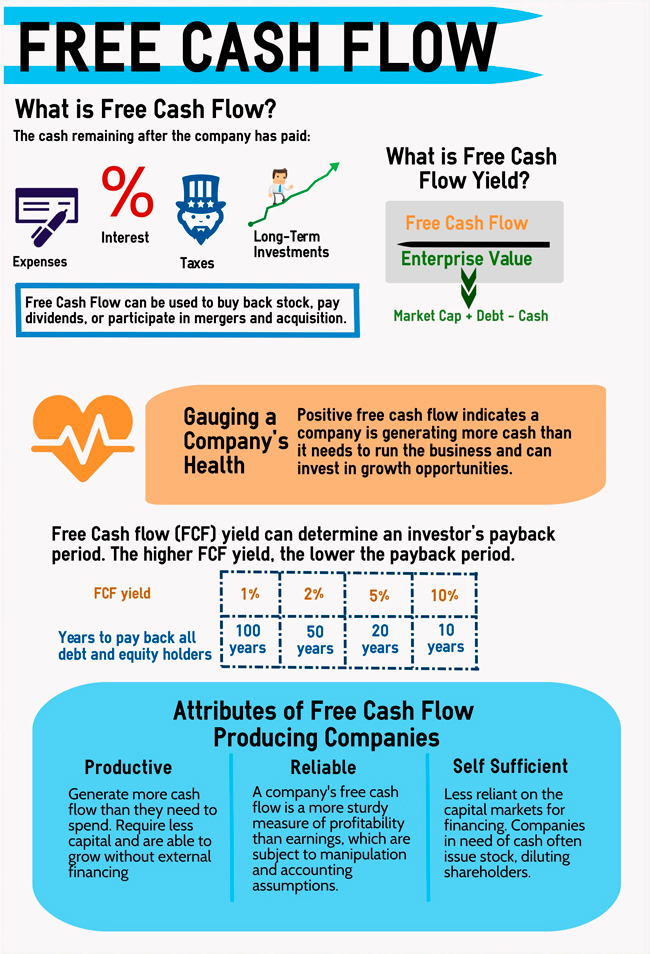

. Then the free cash flow value is divided by the companys value or market cap. It means that the formula. To break it down free cash flow yield is determined first by using a companys cash flow statement subtracting capital expenditures from all cash flow operations.

Its less than its highs but this doesnt mean the markets expensive. Cash flows rose faster than stock prices as the indexs free cash flow FCF yield rose to its highest level since 123118. Per Valuation 101 smart investing is about buying low expectations and selling high expectations.

Weve been told that T ought to be pulling in 20 billion in free cash flow and. If a company is earning above its cost of capital free cash flow yield plus growth is a good rough proxy for expected. Free cash flow yield offers investors or.

We need a metric that tells how highly the market is. Charters 10 Free Cash Flow Yield At 36824 CHTR shares are trading at a 10 FCF Yield. In any event doing some extremely rough math we can derive free cash flow per share in 2023.

As of March 11 the markets free cash flow yield is about 54. The free cash flow yield is around 5 percent but the free cash flow growth rate is 20 to 25 percent easy. Cash may be King but FCF yield is an Ace.

The trailing FCF yield for the SP 500 rose from 11 on 33121 to 2. Here is how I like to think about free cash flow yield. Free Cash Flow is an important metric but the level of FCF by itself does not provide enough information for an investment strategy.

81 from earnings growth plus 54 from dividend payments works out to a powerful 14 total return for investors from IBM stock going forward and divided into the stocks price-to-free cash. A company with a steady free cash flow yield can consider dividend payments share buybacks inorganic and organic growth opportunities Organic Growth Opportunities Organic growth is.

Free Cash Flow Yield The 1 Valuation Multiple Youtube

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Evaluating Stocks Using Free Cash Flow

Cash Flow It S Not The Bottom Line

Net Present Value Calculation Estimating Intrinsic Value All Steps Getmoneyrich

Softcat Primed For It Outsourcing Market Share Run Shares Magazine

Solved The Cost Of Equity Using The Discounted Cash Flow Or Chegg Com

Andrew Kuhn On Twitter Question Why Do You Sometimes Price A Stock Off Of Its Free Cash Flow Yield Plus Growth Rate Instead Of Just Using Its P E Ratio Answer Https T Co 8yudfvnii5 Https T Co Ssgavivffr

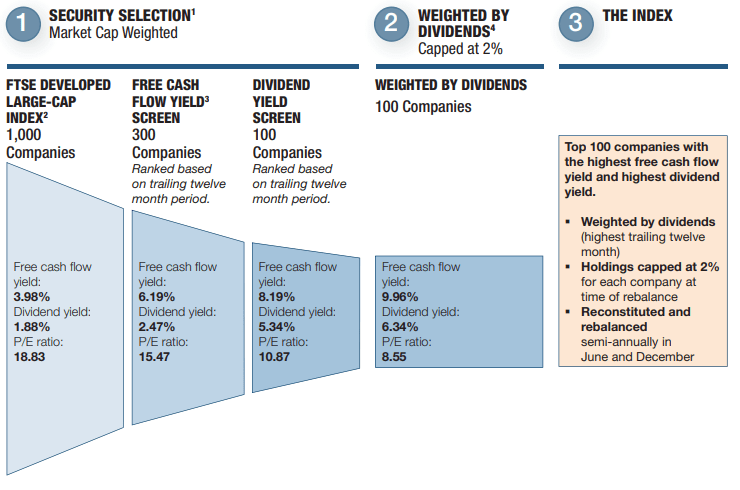

The Power Of Free Cash Flow Yield Pacer Etfs

3 High Yield Stocks Growing Fr Gurufocus Com

:max_bytes(150000):strip_icc()/applecfs2019-f5459526c78a46a89131fd59046d7c43.jpg)

Comparing Free Cash Flow Vs Operating Cash Flow

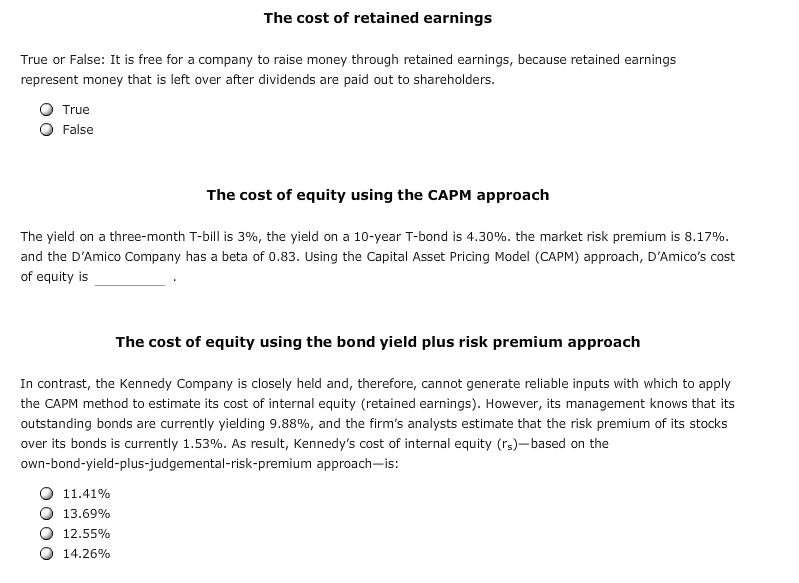

Methods To Calculating The Cost Of Retained Earnings Or Common Equity Universal Cpa Review

Seven Stocks For Cheap Cash Flow And Good Yields Investors Chronicle

Vetting Gcow Michael Burry Says Free Cash Flow On Sale Bats Gcow Seeking Alpha

Terry Smith Free Cash Flow Yield Explained Youtube

All Cap Analysis Free Cash Flow Yield Falls In 2020

Andrew Kuhn On Twitter A New Free Article Is Out Free Cash Flow Plus Growth Isn T It Just Double Counting Quality Of Earnings Otcm Vs Iehc Warren Buffett S